Hmm...so much for one more question on this topic.

I'm using Quickbooks 2008 Canadian Version and now struggling with your first suggestion:

If I use the following sql code I can put in a one line item bill and it automatically calculates taxes (I assume it must get the correct tax code from the Vendor table)

sSQL = "INSERT INTO BillItemLine (VendorRefListID, RefNumber, ItemLineItemRefListID, ItemLineDesc, " & _

"ItemLineQuantity, ItemLineCost, Memo, TxnDate, TermsRefListID) " & _

"VALUES ('" & strVendorRefListID & "', '" & strRefNum & "', '" & strItemLineItemRefListID & "', " & _

"'" & strItemLineDesc & "', 1, " & dblItemLineCost & ", 'Bill created by xxx software', {d '" & strTxnDate & "'}, '" & strTermRefListID & "')"

In Quickbooks 2007 we successfully used the following sql code for a line item without taxes (where we would provide the blank tax code RefListID)

sSQL = "INSERT INTO BillItemLine (VendorRefListID, RefNumber, ItemLineItemRefListID, ItemLineDesc, " & _

"ItemLineQuantity, ItemLineCost, Memo, ItemLineTaxCodeRefListID, Tax1Total, TxnDate, TermsRefListID) " & _

"VALUES ('" & strVendorRefListID & "', '" & strRefNum & "', '" & strItemLineItemRefListID & "', " & _

"'" & strItemLineDesc & "', 1, " & dblItemLineCost & ", 'Bill created by xxx software', " & _

"'" & strItemLineTaxCodeRefListID & "', 0, {d '" & strTxnDate & "'}, '" & strTermRefListID & "')"

In Quickbook 2008 the above code does not work....again we have checked the values

Here is the bottom part of the Trace Log:

2008-07-30 11:26:24 QODBC Ver: 8.00.00.242 *********************************************************************************************************************

IsAService: False

SQL Statement: INSERT INTO BillItemLine (VendorRefListID, RefNumber, ItemLineItemRefListID, ItemLineDesc, ItemLineQuantity, ItemLineCost, Memo, ItemLineTaxCodeRefListID, Tax1Total, TxnDate, TermsRefListID) VALUES ('800000FF-1217442310', '8000', '8000001C-1217442324

', '2007 BMW 235 - Base Invoice', 1, 10000, 'Bill created by xxx software, '60000-1078291348', 0, {d '2008-07-27'}, '10000-1078292074')

Error parsing complete XML return string (8)

Input XML:

<?xml version="1.0" encoding="ISO-8859-1"?>

<?qbxml version="6.0"?>

<QBXML>

<QBXMLMsgsRq onError = "continueOnError" responseData = "includeAll">

<BillAddRq requestID = "1">

<BillAdd defMacro = "TxnID:9361C369-72DE-40F1-92DD-E4F60221C105">

<VendorRef>

<ListID>800000FF-1217442310</ListID>

</VendorRef>

<TxnDate>2008-07-27</TxnDate>

<RefNumber>8000</RefNumber>

<TermsRef>

<ListID>10000-1078292074</ListID>

</TermsRef>

<Memo>Bill created by SureFire</Memo>

<ItemLineAdd>

<ItemRef>

<ListID>8000001C-1217442324</ListID>

</ItemRef>

<Desc>2007 BMW 235 - Base Invoice</Desc>

<Quantity>1.00000</Quantity>

<Cost>10000.00000</Cost>

<TaxCodeRef>

<ListID>60000-1078291348</ListID>

</TaxCodeRef>

</ItemLineAdd>

<Tax1Total>0.00</Tax1Total>

</BillAdd>

</BillAddRq>

</QBXMLMsgsRq>

</QBXML>

ISAM_ERR_IN_COMP_SQL S0000 00000 [QODBC] Error parsing complete XML return string.

ISAMGetErrorMessage

0x0BF056A8 [ISAM]

S0000 00000 [QODBC] Error parsing complete XML return string.

ISAMClearUpdateRecord

0x0BF056A8 [ISAM]

0x0C08DB38 [BillItemLine]

NO_ISAM_ERR 00000 00000

ISAMCloseTable

0x0BF056A8 [ISAM]

0x0C08DB38 [BillItemLine]

NO_ISAM_ERR 00000 00000

ISAMClose

0x0BF056A8 [ISAM]

NO_ISAM_ERR 00000 00000

*********************************************************************************************************************

Would it be possible for you to provide an example of what Insert statements we would use to add in a line for a non-taxable item and a line for a taxable item?

Thx...Don |

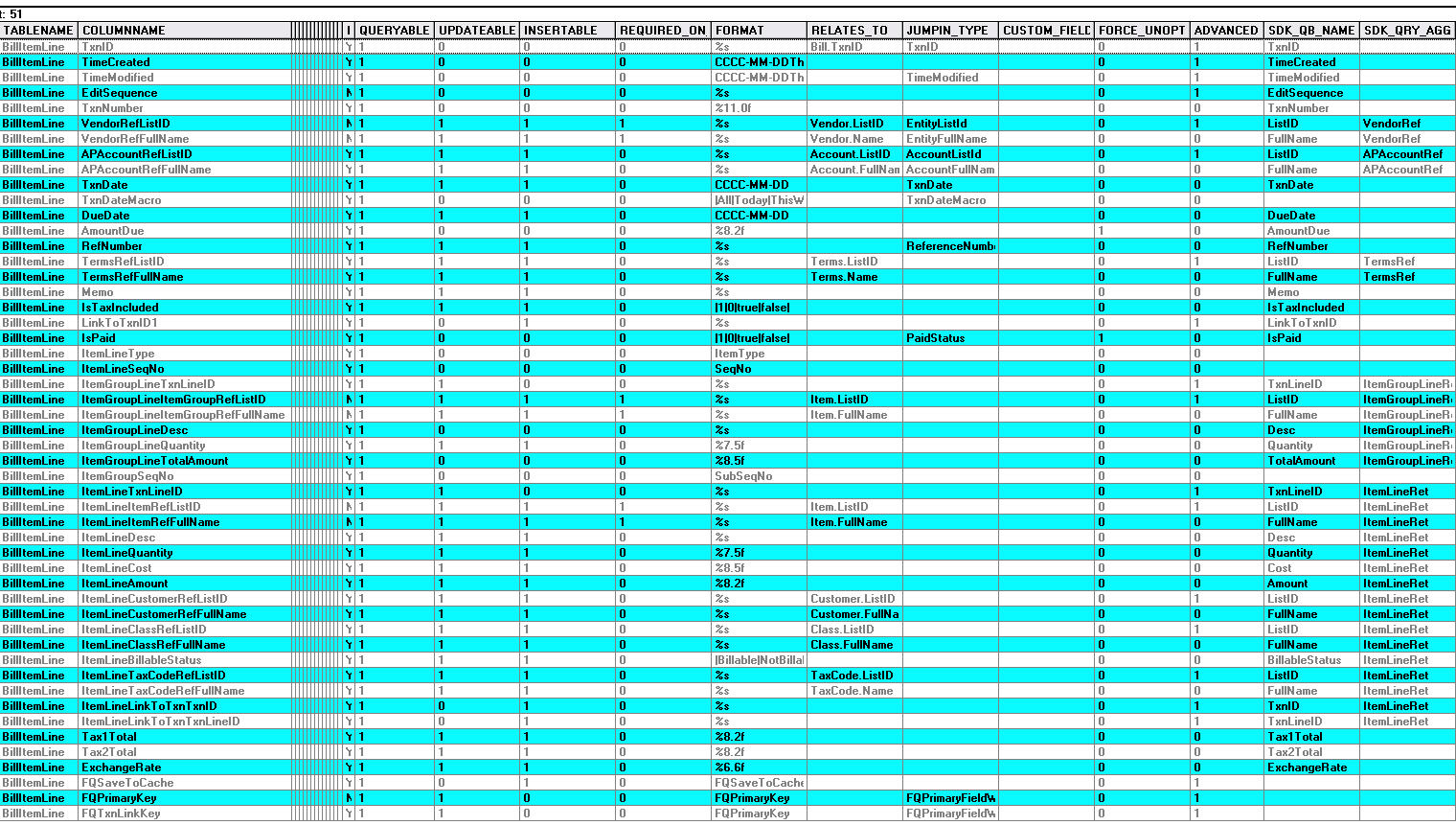

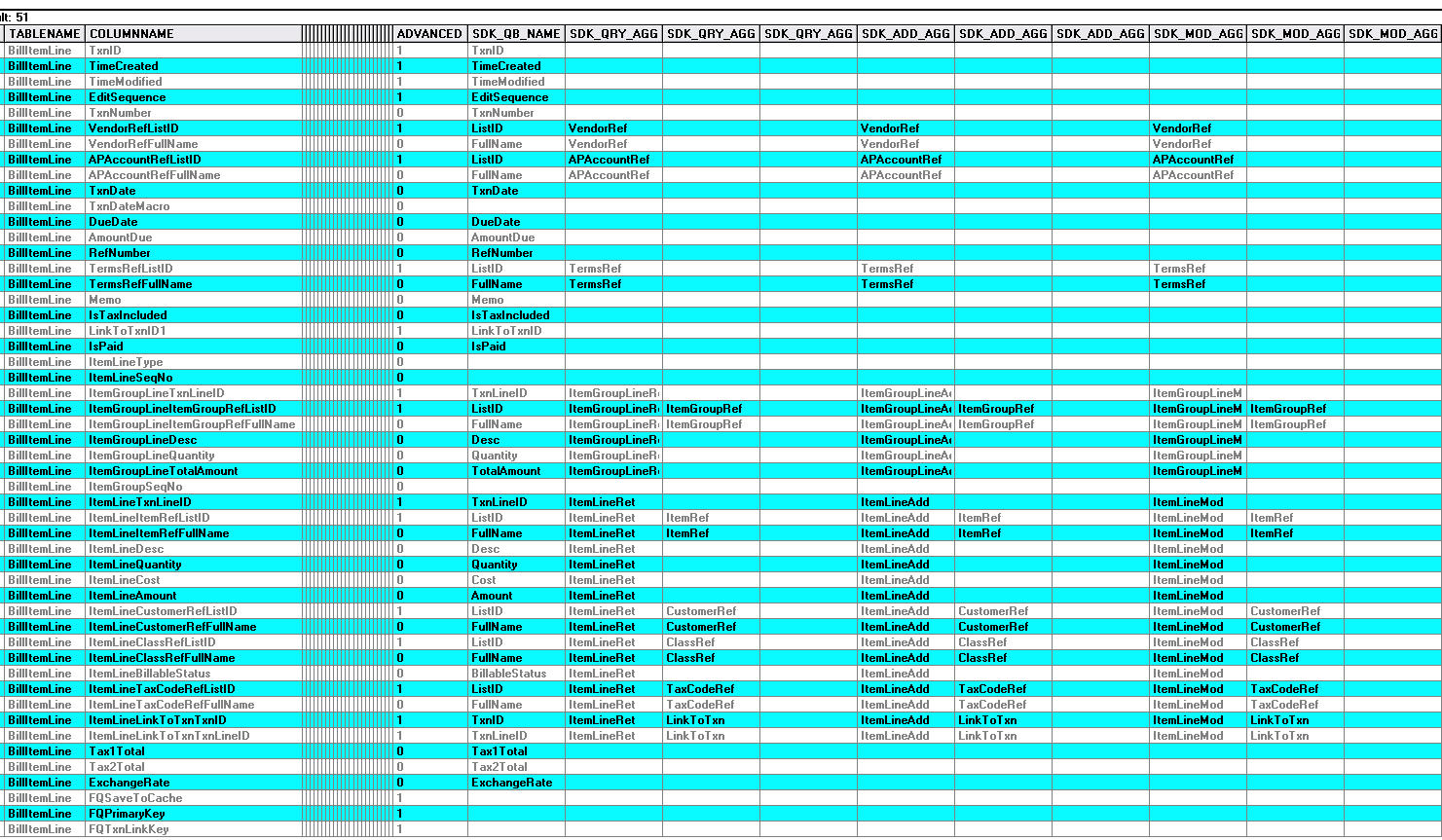

.jpg) Hi Tom here are the 3 screen dumps

Hi Tom here are the 3 screen dumps