|

Buy Support

Incidents |

|

If you can't find your answer

in the FREE PUBLIC QDeveloper Forum, require URGENT Priority Support, or you need to send us

private or confidential information: |

|

Click Here

|

If you can't

login and post questions or you are having trouble viewing forum posts:

Click Here

|

Callback

Support |

|

If you live in USA, UK, Canada, Australia or New

Zealand, you can leave us details on your question and request us to call you back and discuss

them with you personally (charges apply). |

|

Click Here

|

Buy Support

Incidents |

|

If you can't find your answer

in the FREE PUBLIC QDeveloper Forum, require URGENT Priority Support, or you need to send us

private or confidential information: |

|

Click Here

|

|

| Tax Percents |

| Author |

Message |

|

|

| Posted : 2007-09-05 04:26:30 |

I'm trying to work through some tax issues, but I'm unsure of which table holds the actual tax percent for a particular customer, service, item, etc etc.

Thanks,

Joanna |

|

|

|

| Tom |

|

| Group | : Administrator |

| Posts | : 5510 |

| Joined | : 2006-02-17 |

|

| Profile |

|

| Posted : 2007-09-05 10:11:11 |

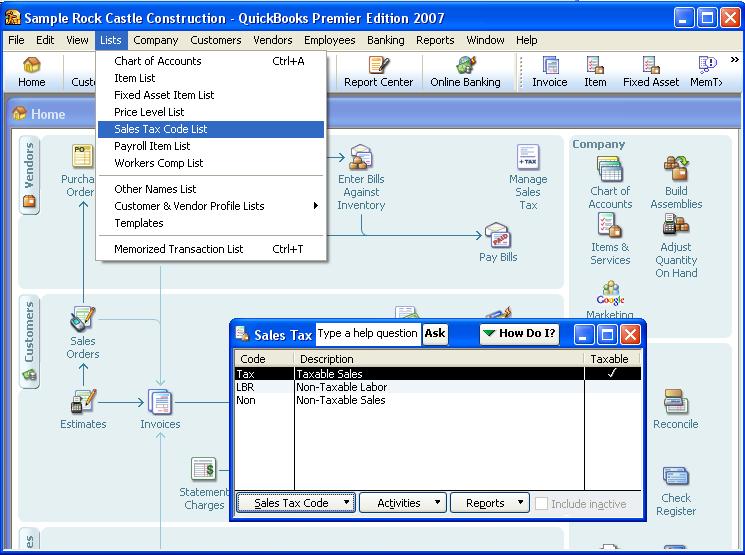

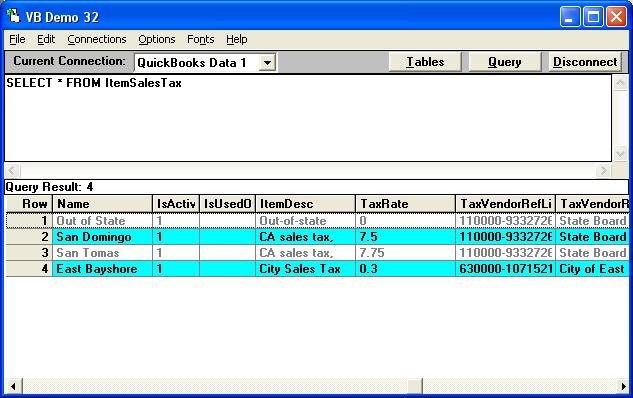

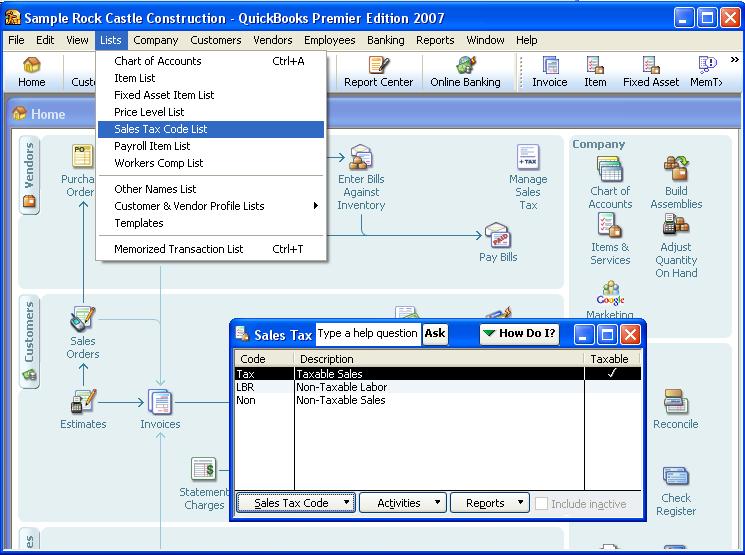

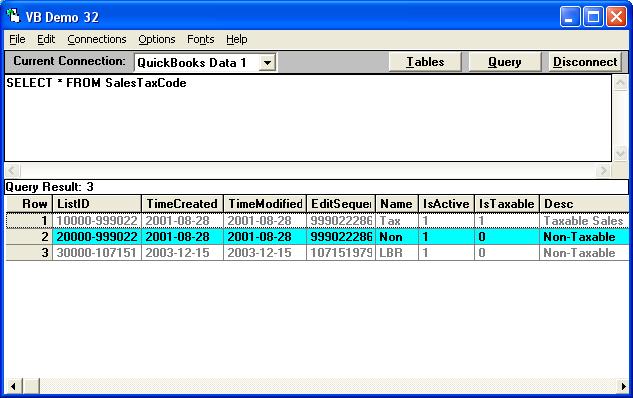

The QuickBooks Sales Tax Code List:

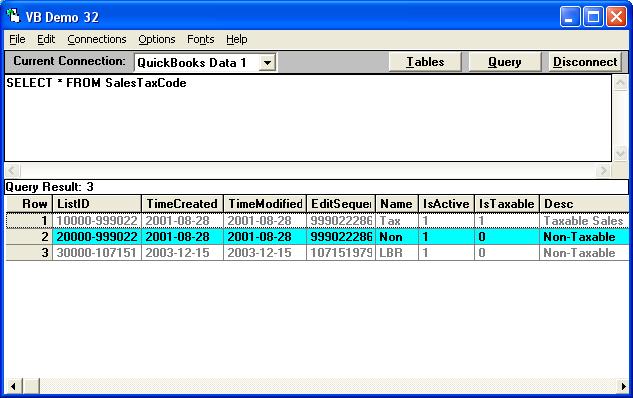

is found in the SaleTaxCode table:

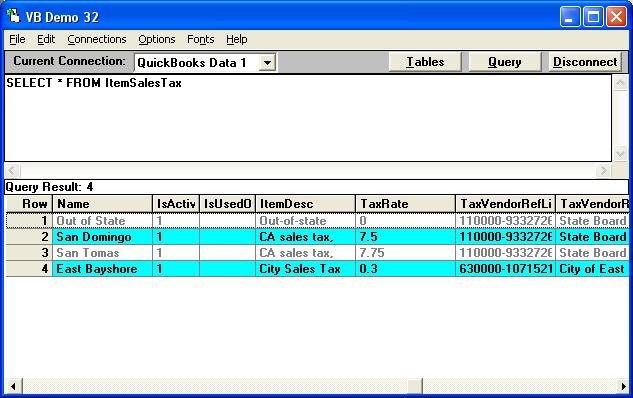

The QuickBooks Tax Item List:

is found in the ItemSalesTax table (including the TaxRate percentage):

|

|

|

|

|

|

| Posted : 2007-09-06 01:50:35 |

Thank you Tom, this was very helpful!!

Now I am curious if Quickbooks can differentiate between a parts tax and a service tax? It seems to me that tax is determined by customer, and only one tax rate can be applied to any particular invoice. Is this true? Or is it possible to differentiate between those items on an invoice that are parts (with one tax rate) and those that are services (with a different tax rate).

Thank you again,

Joanna |

|

|

|

| Tom |

|

| Group | : Administrator |

| Posts | : 5510 |

| Joined | : 2006-02-17 |

|

| Profile |

|

| Posted : 2007-09-06 08:42:42 |

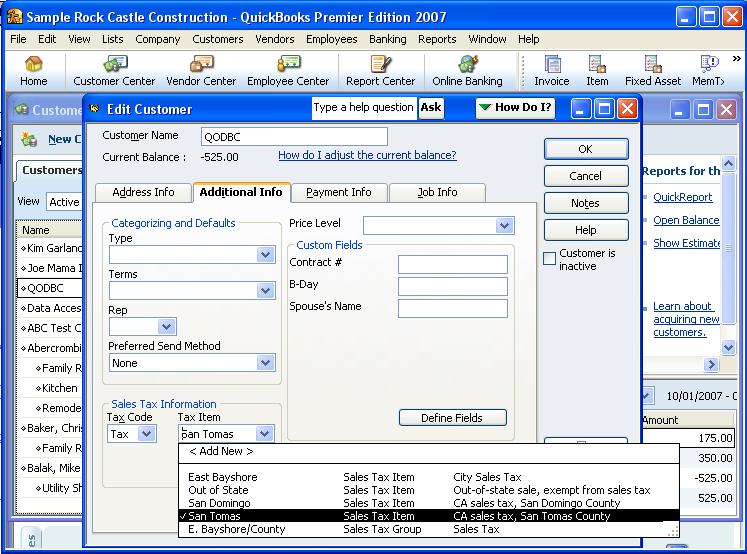

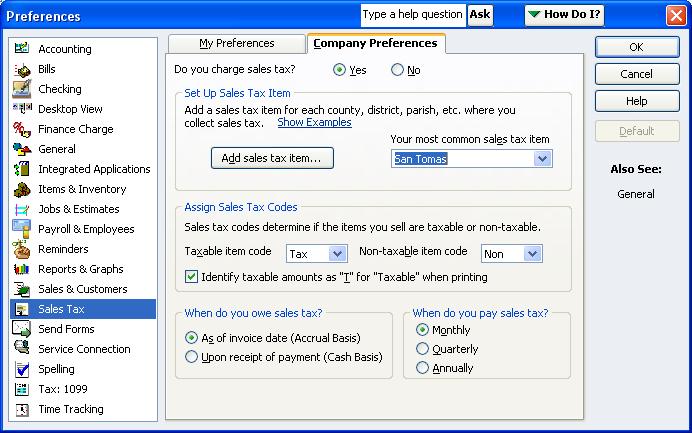

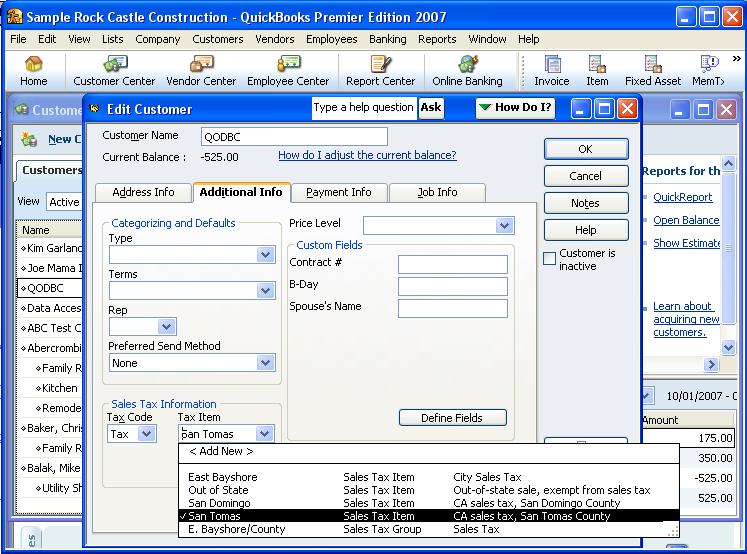

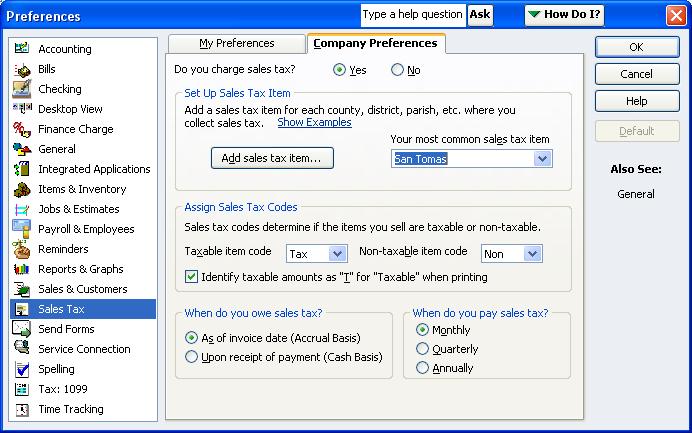

All customer records contain both a sales tax code and a sales tax item. When you create a new customer, assuming you opted to make customers taxable, the sale tax code Tax is automatically applied, and the sales tax item you specified in the Most Common Sales Tax Item in the Sales Tax Preferences dialog is also automatically applied.

With over 7,600 sales tax rates in the United States, please consult your nearest QuickBooks Professional on how you should setup Sales Tax. |

|

|

|

|