If you do a Journal entry that debits Undeposited Funds, and credits A/R for the customer, then the journal ends up appearing in the ReceivePaymentToDeposit table the same way as doing a Receive a Payment to Deposit using QuickBooks in the first place. So I wouldn't do the journals and I would do the following instead:

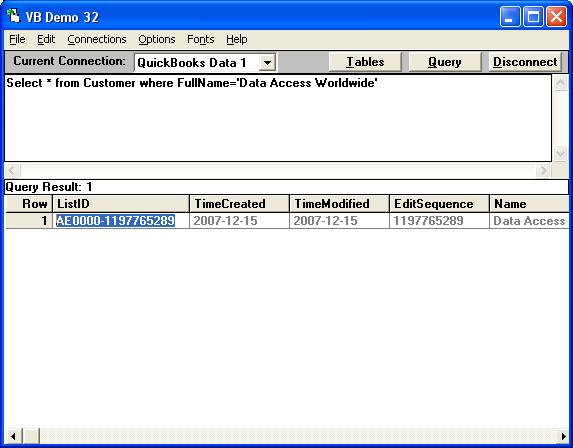

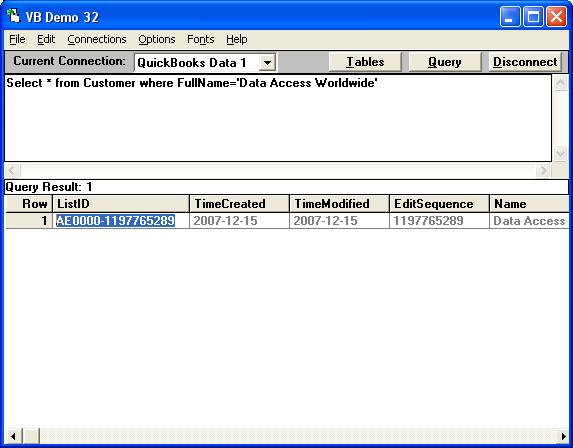

First , locate the ListID for the customer by doing:

Select * from Customer where FullName='Data Access Worldwide'

For the "Data Access Worldwide" customer the ListID is: AE0000-1197765289.

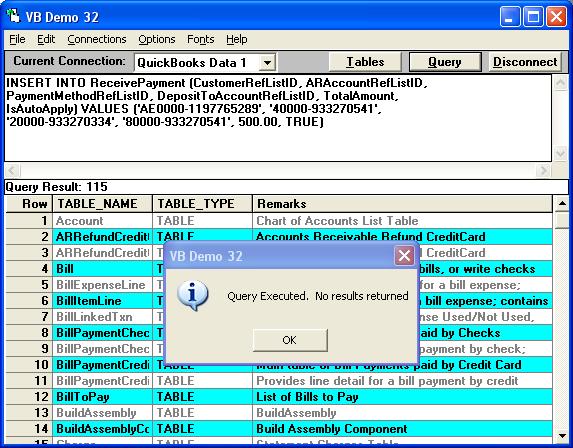

TO RECEIVE THE PAYMENT FOR THE CUSTOMER WITHOUT ANY INVOICES

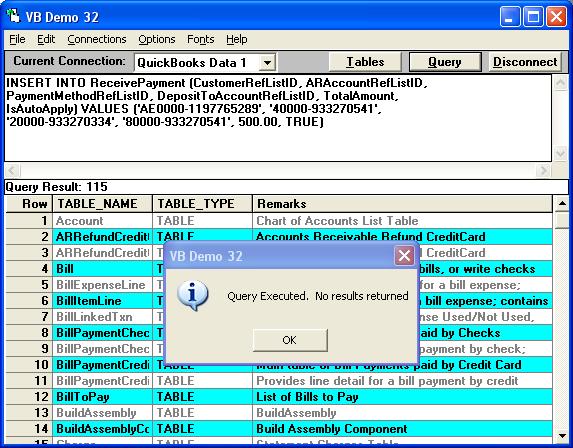

INSERT INTO ReceivePayment (CustomerRefListID, ARAccountRefListID,

PaymentMethodRefListID, DepositToAccountRefListID, TotalAmount,

IsAutoApply) VALUES ('AE0000-1197765289', '40000-933270541',

'20000-933270334', '80000-933270541', 500.00, TRUE)

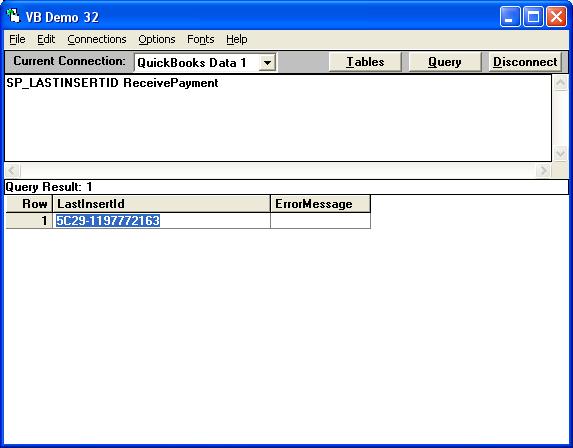

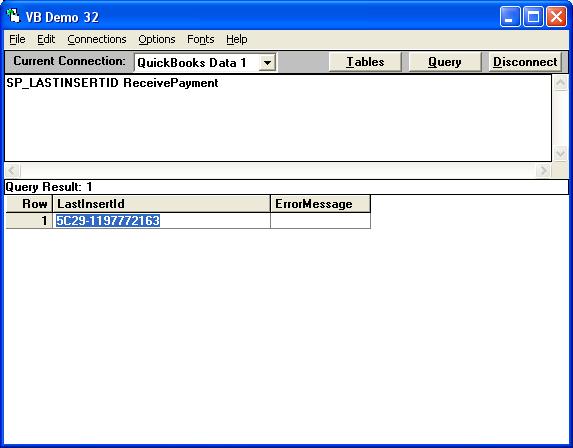

The transaction ID for the payment we just did is found by doing:

SP_LASTINSERTID ReceivePayment

It returned a TxnID of: 5C29-1197772163

The insert also created a ReceivePaymentToDeposit line found by doing:

Select * from ReceivePaymentToDeposit where TxnID='5C29-1197772163'

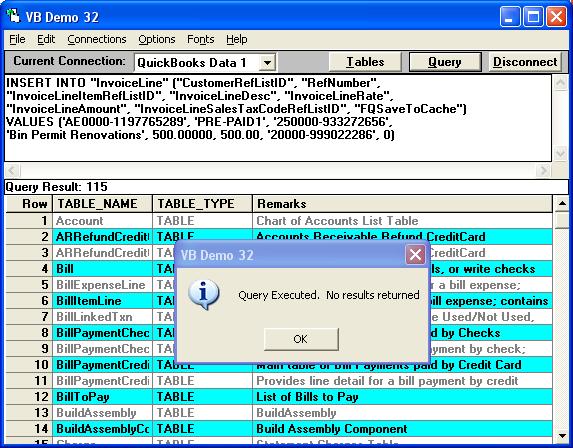

NOW YOU CAN CREATE THE INVOICE

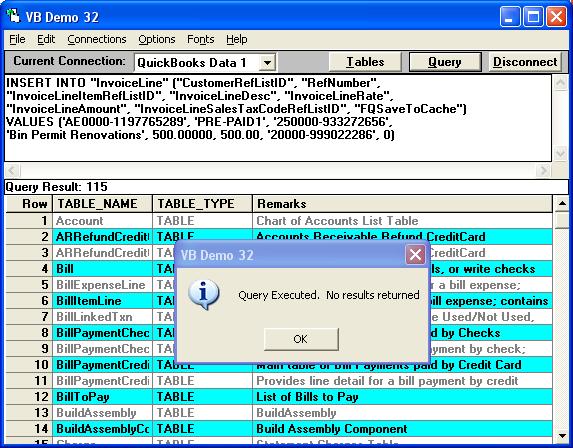

INSERT INTO "InvoiceLine" ("CustomerRefListID", "RefNumber",

"InvoiceLineItemRefListID", "InvoiceLineDesc", "InvoiceLineRate",

"InvoiceLineAmount", "InvoiceLineSalesTaxCodeRefListID", "FQSaveToCache")

VALUES ('AE0000-1197765289', 'PRE-PAID1', '250000-933272656',

'Bin Permit Renovations', 500.00000, 500.00, '20000-999022286', 0)

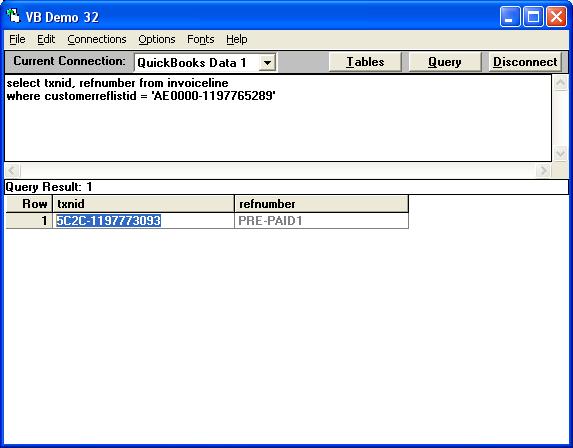

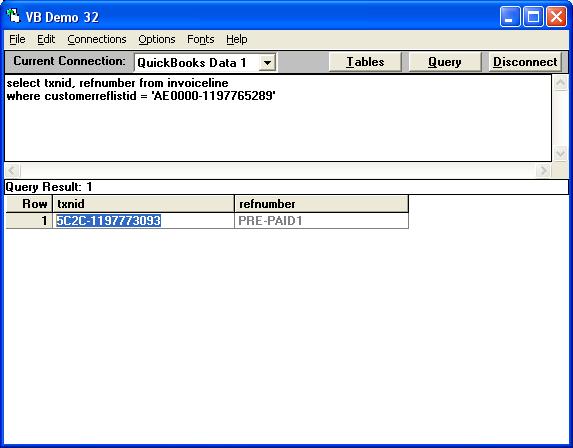

To locate the Transaction ID for the Invoice you can do:

select txnid, refnumber from invoiceline

where customerreflistid = 'AE0000-1197765289'

The TxnID of the Invoice is: 5C2C-1197773093

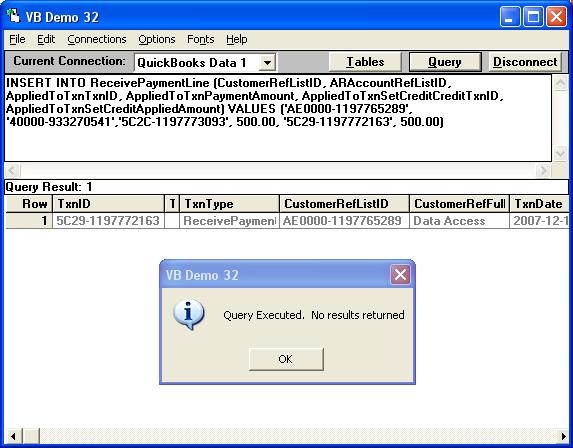

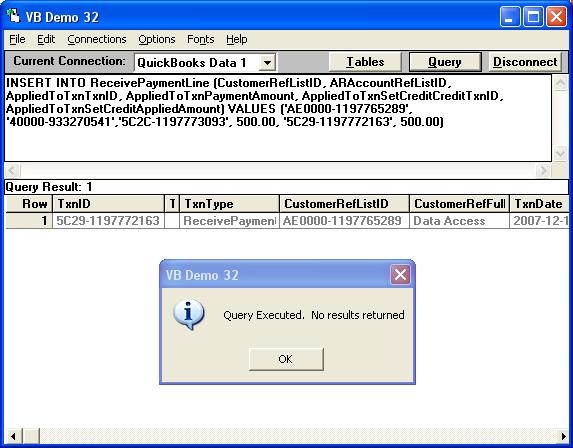

TO APPLY THE PAYMENT TO THE INVOIVCE

So now there's a invoice you can do a ReceivePaymentLine to apply that payment to the Invoice and credit the unapplied payment! :

INSERT INTO ReceivePaymentLine (CustomerRefListID, ARAccountRefListID,

AppliedToTxnTxnID, AppliedToTxnPaymentAmount, AppliedToTxnSetCreditCreditTxnID,

AppliedToTxnSetCreditAppliedAmount) VALUES ('AE0000-1197765289',

'40000-933270541','5C2C-1197773093', 500.00, '5C29-1197772163', 500.00)

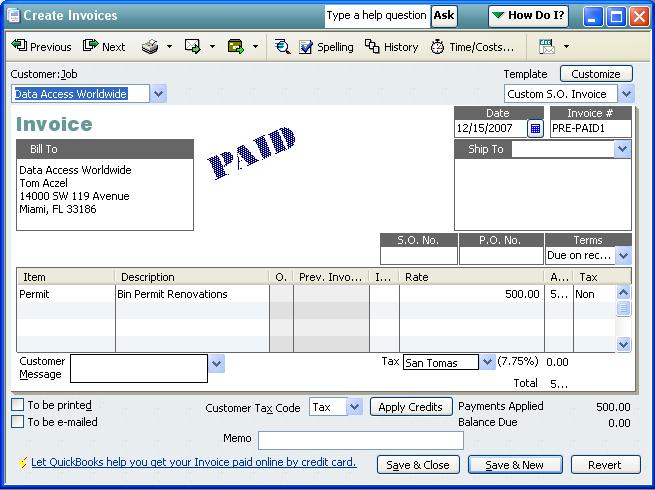

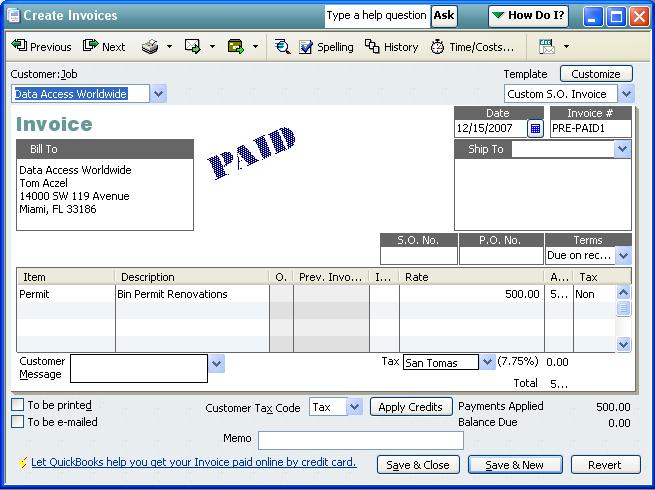

The Invoice now displays as PAID !

Where:

CustomerRefListID = 'AE0000-1197765289' (Customer ListID - Required)

DepositToAccountRefListID = '80000-933270541' (Undeposited Funds Account ListID)

ARAccountRefListID = '40000-933270541' (Accounts Receivable Account ListID)

AppliedToTxnTxnID = '5C2C-1197773093' (Find TxnID in Invoice Table)

AppliedToTxnSetCreditCreditTxnID = '5C29-1197772163' (Find TxnID form ReceivePaymentToDeposit Table)

|